What Does Home Renovation Loan Do?

What Does Home Renovation Loan Do?

Blog Article

The Best Strategy To Use For Home Renovation Loan

Table of ContentsThe Greatest Guide To Home Renovation LoanThe Only Guide to Home Renovation LoanNot known Details About Home Renovation Loan 8 Easy Facts About Home Renovation Loan ExplainedThe Definitive Guide to Home Renovation Loan

With the capacity to deal with points up or make upgrades, homes that you may have formerly passed over now have possible. Some residences that call for upgrades or renovations may also be readily available at a lowered rate when contrasted to move-in all set homes.This implies you can obtain the funds to buy the home and your planned renovations all in one financing.

The rates of interest on home renovation loans are commonly lower than individual finances, and there will be an EIR, called efficient rate of interest, for every single restoration lending you take, which is prices along with the base rate of interest, such as the management charge that a financial institution might bill.

Rumored Buzz on Home Renovation Loan

If you've only got a minute: A remodelling financing is a funding solution that helps you better manage your cashflow. Its effective rates of interest is less than various other typical funding choices, such as bank card and personal funding. Whether you have actually just recently acquired a brand-new home, making your home extra helpful for hybrid-work setups or designing a nursery to welcome a new child, remodelling strategies could be on your mind and its time to make your plans a reality.

A 5-figure amount appears to be the standard, with comprehensive remodellings surpassing S$ 100,000 for some. Here's when obtaining an improvement loan can aid to enhance your capital. A renovation financing is meant only for the funding of restorations of both new and existing homes. After the loan is accepted, a managing fee of 2% of accepted finance quantity and insurance coverage costs of 1% of authorized car loan quantity will certainly be payable and deducted from the authorized car loan quantity.

Following that, the finance will certainly be paid out to the service providers using Cashier's Order(s) (COs). While the optimum number of COs to be provided is 4, any kind of additional CO after the initial will incur a charge of S$ 5 and it will certainly be subtracted from your designated financing servicing account. On top of that, costs would certainly also be incurred in case of termination, pre-payment and late settlement with the fees received the table listed below.

The 10-Second Trick For Home Renovation Loan

Furthermore, website sees would be conducted after the disbursement of the funding to make certain that the loan profits are made use of for the mentioned improvement functions as provided in the quotation. home renovation loan. Really commonly, remodelling fundings are compared to individual finances however there are some advantages to obtain the former if you need a loan especially for home improvements

If a hybrid-work arrangement has now come to be a permanent function, it may be excellent to consider refurbishing your home to develop a more work-friendly atmosphere, enabling you to have actually a marked job space. Once again, an improvement car loan might be a valuable economic device to plug your capital space. Nevertheless, restoration lendings do have a rather strict usage policy and it can only be utilized for improvements which are irreversible in nature.

If you locate on your own still requiring aid to money your home equipping, you can use up a DBS Personal financing or prepare money with DBS Cashline to pay for them. One of the most significant mistaken beliefs regarding restoration funding is the viewed high rates of interest as the published passion price is more than personal loan.

Some Known Factual Statements About Home Renovation Loan

Moreover, you stand to take pleasure in a much more attractive rates of interest when you make environmentally-conscious choices with the DBS Eco-aware Restoration Funding. To certify, all you need to do is to fulfil any kind of 6 out of the 10 products that apply to you under the "Eco-aware Renovation List" in the application type.

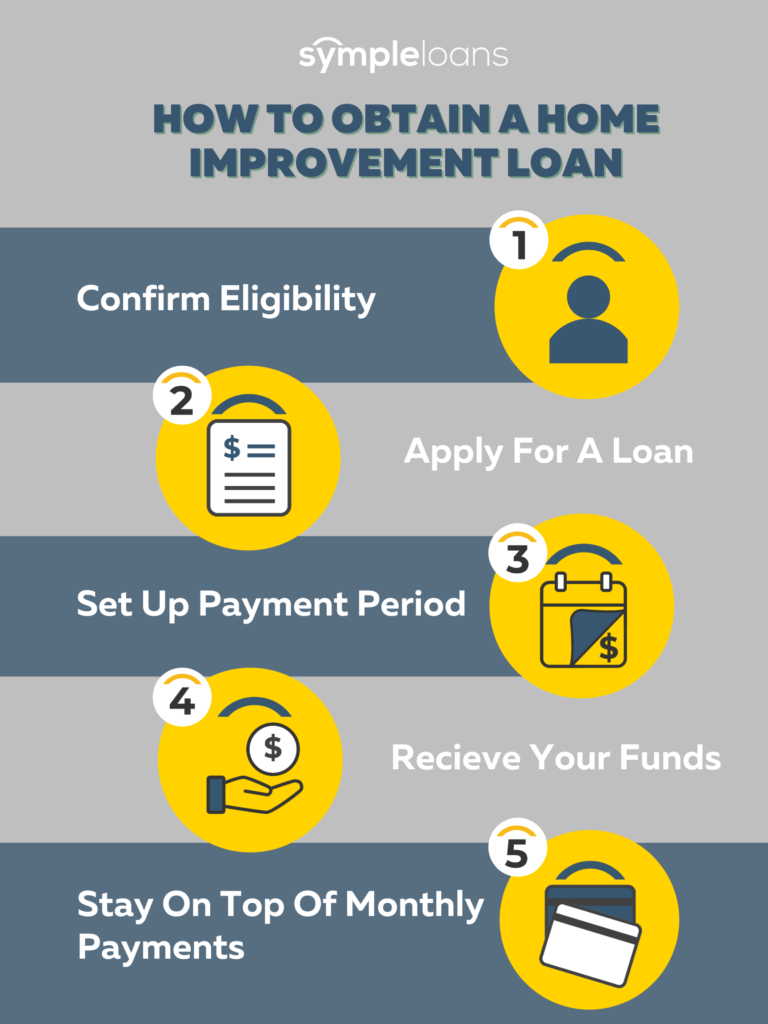

Or else, the steps are as follows. For Solitary Candidates (Online Application) Step 1 Prepare the called for papers for your renovation finance application: Scanned/ Digital invoice or quote signed by contractor and candidate(s) Income Documents Proof of Possession (Waived if restoration is for home under DBS/POSB Home Loan) HDB or MCST Restoration Authorization (for applicants that are proprietors of the designated specialist) Please keep in mind that each file size must not exceed 5MB and acceptable styles are PDF, JPG or JPEG.

The 20-Second Trick For Home Renovation Loan

Applying home improvements can have many favorable impacts. Getting the appropriate home improvement can be done by making use of one of the lots of home remodelling car loans that are available to Canadians.

They offer proprietors personality homes that are central to neighborhood features, provide a cosmopolitan design of life, and are normally in rising next page markets. The downside is that much of these homes need updating, often to the entire home. To obtain those updates done, it needs financing. This can be a home equity loan, home credit line, home refinancing, or other home money choices that can provide the cash needed for those revamps.

Home renovations are possible with a home improvement lending or an additional line of credit report. These kinds of loans can give the property owner the capability to do a number of various points.

Report this page